Forex Trading

Forex Money Managment

Contents:

So let’s just put it on the chart and then show you exactly how it works. Even the most successful Forex money managers have bad years. A risk-reward ratio must adapt to the market used. Such ratios differ from market to market, of course.

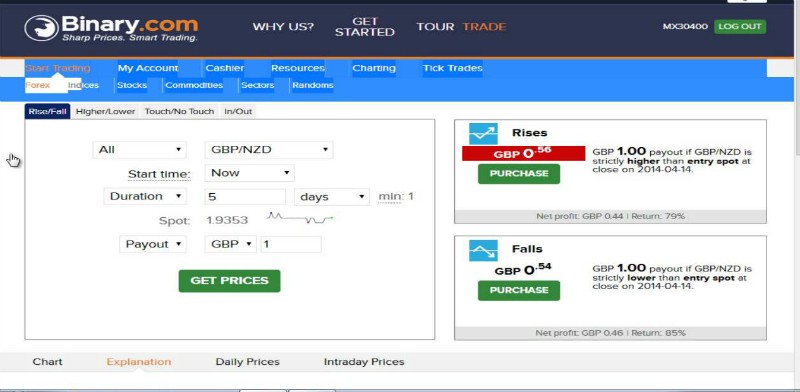

How To Make Money With Binary Option? Free Guide 2023 – Biz Report

How To Make Money With Binary Option? Free Guide 2023.

Posted: Thu, 16 Feb 2023 08:00:00 GMT [source]

The first method generates many minor instances of psychological pain, but it produces a few major moments of ecstasy. On the other hand, the second strategy offers many minor instances of joy, but at the expense of experiencing a few very nasty psychological hits. With this wide-stop approach, it is not unusual to lose a week or even a month’s worth of profits in one or two trades. A trailing stop is a point at which you move the stop “x” amount if pips from the current price level and continue to move the stop loss “x” pips from the current price level as it moves in your favour. This is a good way to attempt to maximise profits from a trade. Trailing stop losses can work especially well in trending markets.

Moving a stop loss to ‘breakeven’ can kill your account

Whatever strategy you learn, you must know how to use that strategy in different market conditions. Never doubt your well-working strategy, Don’t compare yourself with other traders. You need to make money faster in this world, but don’t depend only on the market to give you big money faster. Watching other traders profit results and trying to do the same. If there’s a losing trade running on, Waiting for that losing trade to close at zero . It is very important to handle emotions such as fear of losing money, anxiety, panic situation while trading.

So, you need to https://trading-market.org/ a stop loss at $ 4 so that the loss does not exceed 1% of the deposit ($ 1). Money management controls the risk to your account to preserve capital and prevents a small number of losing trades from disproportionately damaging your account. Leverage is an option but not an obligation to use.

Risk in Forex Trading – Forex Money Management Tools

The money management is without doubt the other side of the coin that must be mastered to turn the consistent winners into consistent money. Well, since most traders have a tendency to increase their risk size after a winning trade or after a series of winners, this is typically something you want to avoid. Basically, doing the opposite of whatever “most traders” do can be considered a “secret” of trading…and when it comes to money management there are quite a few of these “secrets”.

We believe, all our members are growing well in Forex with us by learning a lot of useful guidance. You always keep improving your Trading skills faster with our Experts Support. You should have to be patience and wait for a good opportunity to enter the market.

Money Management Forex

With this method, you decide how many percent of your account you want to risk per trade, for example, 2%, and you continue to risk 2% as your account gets bigger or smaller. Some straightforward and easy-to-follow money management rules can immediately help your trading. The main thing for beginner traders to learn is how to predict trend reversals. But when this task is completed, you can proceed to more sophisticated forecasts and make a prognosis of how much will the price fall or increase. Forex head and shoulders pattern is respected by traders all over the world precisely because it helps to perform both of these tasks very well.

- However, one of the big benefits of trading the spot forex markets is the availability of high leverage.

- The reason for this rule is that you want to survive, and only once you survive can you make money.

- These types of “confirmed” breakouts from key levels can also be very good opportunities to try and trail your stop to let the trade run.

- As our account gets bigger or smaller, we would continue risking 2% and making sure we are not using too much leverage.

A pig thinks to become get rich quick by trading with high lots. The pig can get slaughtered if the market drops and all his/her investments are lost. Futures and Options trading carries high risks as well as high rewards. You must be aware and willing to accept the risks to invest in the markets.

This is how professional traders react to the market at all conditions. They remain Polite and calm at all the market conditions. Even if the market crashes or gain a lot of profit on the trade.

The best trading planwill be written down with a clear rule set that is easy for you to follow. This ruleset can help you minimize your losses and take advantage of the larger winners. You may decide that if you lose 25% of your account, it is time to take a break and work out what is going wrong.

We’ve already talked about leverage in other articles, and we’ve given a very precise explanation of what it is and how it works. I see many people, even those who already invest in the foreign exchange market, who don’t know what forex swap is. 5 as a risk-reward ratio, as discussed earlier. The above represents the basics of diversification. Complex algorithms help the Forex money management industry to find the best portfolio allocation across various currencies. Therefore, you spread the risk of a wrong entry across multiple levels.

The https://forexarena.net/ is unpredictable, and you risk merging the entire deposit with just one unsuccessful transaction. Forex trading requires leverage because the actual price movements between currencies are very small. Leverage allows us to capitalize on small price movements with a reasonable account size.

If the https://forexaggregator.com/r ‘needs’ the trade to win because the money is required for other purposes, the trader is liable to make bad decisions and increase the odds of losing money. “Hope for the best and plan for the worse” by trading with funds that would not hurt your lifestyle if you lost them. Of course there are some disadvantages to using stop losses, the most frustrating of which is seeing a stop loss triggered, only for the trade turn around and hit the take profit level. But as annoying as that experience might be, it is worth keeping a stop loss to avoid those occasions when the price does not turn around quickly and leaves the account with an unmanageable loss. The disadvantage with this strategy is that it does not take into account any changes in your trading balance. If you go on a series of wins and grow your account substantially, but still stick to the same risk per trade, you could be missing out on greater returns.

You can use a correlation calculator from investing.com to quickly see any potential positive or negative correlation your trades might have. If you don’t use correlation wisely, you can quickly risk more money than you wanted. The best way to make sure you are not using too much leverage is to calculate what trade size you should be using before each trade. If you correctly calculate your risk on each trade, then you can make sure you are risking the right amounts.